Special EU VAT rules for international transport

by Ineke C. J. M. Schellen

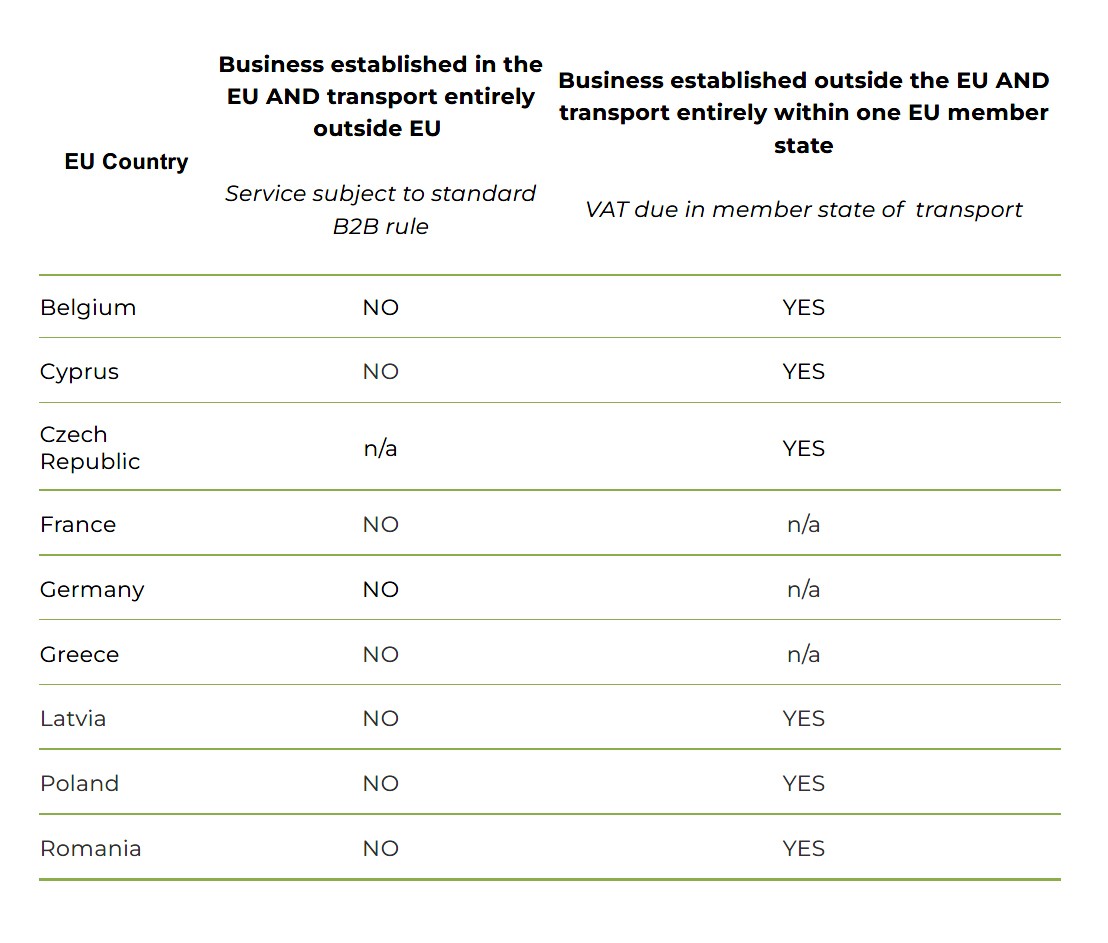

Under European VAT law, transport services are subject to the general B2B rule, i.e. in the member state where the recipient is located, transport services are taxable and the VAT due is levied from the recipient via a reverse charge. However, some member states have introduced special rules that deviate from the general rule in cases where the transport is outside the EU (e.g. US to Canada), or takes place within a single member state (e.g. from Amsterdam to Rotterdam). These special rules are the so-called “effective use and enjoyment rules”.

There are two scenarios in which international transport companies may encounter the effective use of enjoyment rules:

- The recipient is established in an EU member state and the provided transport takes place entirely outside the EU.

- The recipient is established in a non-EU member state and the provided transport takes place entirely within the national borders of an EU member state.

The following chart gives a clear overview of which countries have implemented which rules. (This list is not exhaustive because it does not cover all EU member states.)

In circumstances when transport is provided by a transport company established in an EU member state for non-EU recipients, and when the transport takes place entirely within either Belgium, Cyprus, Czech Republic, Latvia, Poland or Romania, transport providers are especially at risk. They may be liable for VAT in the member state of transport.

Photo: Mike Mareen - stock.adobe.com

/https://storage.googleapis.com/ggi-backend-prod/public/media/3205/trucks-a347702104.jpg)

/https://storage.googleapis.com/ggi-backend-prod/public/media/1835/imageCieELI.jpg)

/https://storage.googleapis.com/ggi-backend-prod/public/media/371/imageAioIfC.png)

/https://storage.googleapis.com/ggi-backend-prod/public/media/7013/b12812aa-aa9c-469e-9f0c-fa6f88d4b9f0.png)

/https://storage.googleapis.com/ggi-backend-prod/public/media/7004/a46e5ac3-a0e3-4bb0-82ba-50347ce0d00f.jpg)

/https://storage.googleapis.com/ggi-backend-prod/public/media/7002/13c928c5-b9f5-42d8-a408-2ee54eec2a0e.jpg)

/https://storage.googleapis.com/ggi-backend-prod/public/media/7001/dec4137f-f664-4e95-9090-e2ea920e5e5d.jpg)