M&A activity and multiples in food processing and handling equipment

by Federico Petrotta

As global megatrends unfold and consumer habits change, manufacturers of food & beverage processing and handling (FP&H) equipment must adapt quickly to survive and reap the benefits of new challenges and opportunities.

For example, consumers’ attention towards sustainability means food and beverage (F&B) players need to downgauge product packaging and use eco-friendly materials. Downgauging is the process of reducing the thickness or “gauge” of a material while maintaining its strength and functionality. It involves using less material to achieve the same performance or functionality as a thicker material.

At the same time, with Industry 4.0 innovations (the integration of intelligent digital technologies into manufacturing and industrial processes), equipment makers can add customer value thanks to remote diagnostics and pre-emptive maintenance.

However, building competencies internally with R&D can be challenging, lengthy and unsuccessful. M&A instead allow manufacturers to acquire know-how and new technologies to be implemented rapidly and effectively.

The FP&H market is fragmented, especially in some regions and segments, comprising both large dominant groups, and a multitude of small and medium enterprises (SMEs) that can be integrated to achieve competitive scale; this is attested by the strong interest of private equity funds in consolidating the industry.

M&A activity in industrial equipment declined globally in terms of total value in 2022, and in the first four months of 2023, due to recent macroeconomic and geopolitical shocks; and earnings before interest, taxes, depreciation, and amortization (EBITDA) multiples dropped to 10.3x in 2022 from 13.7x in 2021. Valuation multiples are ratios used in M&A to assess the value of a company and allow for a quick comparison with the industry and historical benchmark. They are calculated by dividing a financial metric, such as market capitalisation or enterprise value (EV) by a relevant factor, such as net income or EBITDA.

However, the number of transactions rose to 110 from 82 [1], showing that M&A activity in 2022 was driven by the mid-market. Indeed, some countries, like Italy where SMEs make up a major portion of the economy, witnessed an increase of M&A activity in 2022, and Industrials and Chemicals were among the most prominent sectors both in terms of volumes and values [2].

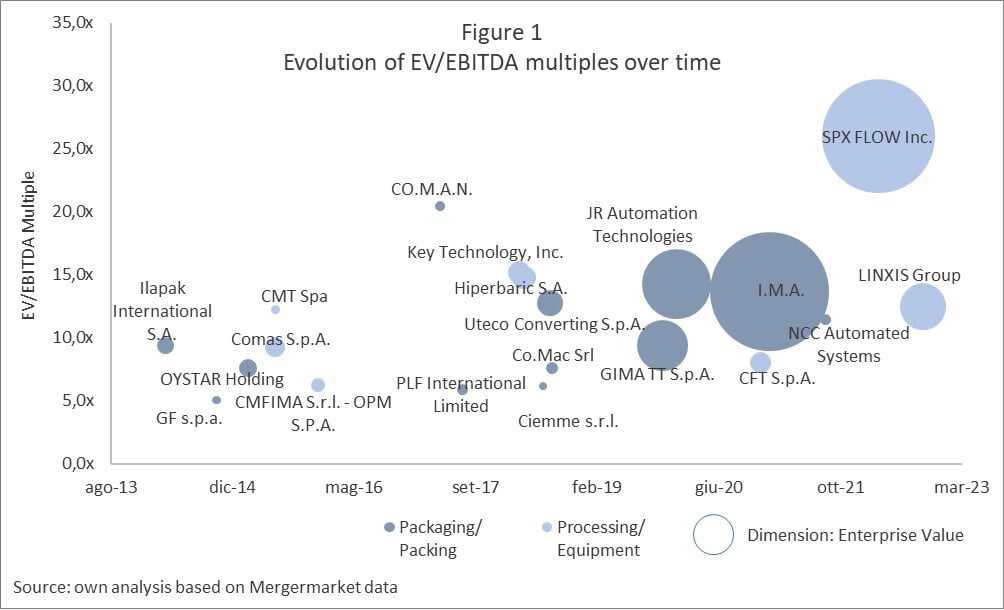

By analysing 24 transactions completed over the last 10 years in the industrial equipment sector (mostly FP&H), it is evident that valuations have stayed stable over time. The upward trend of EBITDA multiples seems to be driven primarily by the magnitude of target companies towards the end of the reference period.

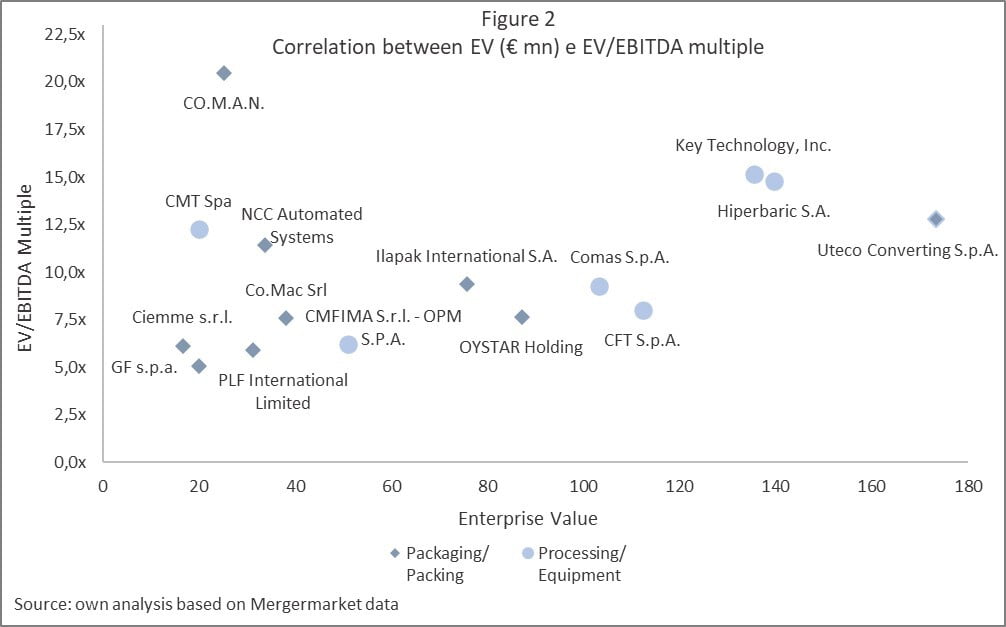

Large firms usually command higher valuations due to perceived advantages such as scale economies and reputation. The resulting median sales multiple is 2.6x for big companies and 1.4x for SMEs, whereas the median EBITDA multiple is 13.6x vs 9.3x for the latter class.

Target companies are further categorised by specialisation on packaging equipment and processing equipment to account for differences in know-how, standards, and competition.

Manufacturers of processing machinery are valued at a premium, with a median sales multiple of 1.8x vs 1.5x for those specialising in packaging, and an EBITDA multiple of 12.4x vs 9.4x.

This premium may be related to processing type and component specialisation, compared to those for packaging, and even more so for packing, which are applied to a wider set of products and face stiffer competition.

While M&A actors globally adopt a cautious approach, the FP&H industry proves dynamic and offers consolidation opportunities. Although valuations depend on several factors, an analysis of M&A multiples offers a guide to evaluate future deals, as evolutions in the industry take place.

SOURCES:

[1] Industrial Equipment Sector Update - April 2023 (Baird Investment Advisor)

[2] M&A Barometer – Review 2022 e Preview 2023 (Ernst & Young)

Federico Petrotta is a Senior Analyst at Cavour Corporate Finance, where he works on M&A mandates with industrial and services companies, and private equity firms. Previously, he gained experience in corporate and consulting, and obtained a MSc in Management and Technology at the Technical University of Munich.

/https://storage.googleapis.com/ggi-backend-prod/public/media/5058/LOGO-SQUARE-Website-Cavour.png)

/https://storage.googleapis.com/ggi-backend-prod/public/media/2762/cavour_corporate_finance_srl.png)

/https://storage.googleapis.com/ggi-backend-prod/public/media/5023/GCG-Capital-Logo.jpg)

/https://storage.googleapis.com/ggi-backend-prod/public/media/7298/GCG-Dealmakers-Report-2026_Front.jpg)

/https://storage.googleapis.com/ggi-backend-prod/public/media/7138/c32c74c8-06df-4634-b9b3-b7541aafbd58.jpg)

/https://storage.googleapis.com/ggi-backend-prod/public/media/7121/3999d493-328a-43b1-91b5-908f9e16839e.jpg)

/https://storage.googleapis.com/ggi-backend-prod/public/media/7120/893311ee-73c5-4d60-9d89-999e4d047882.jpg)