Internal audit for the real estate industry in India

by Jagruti Sheth

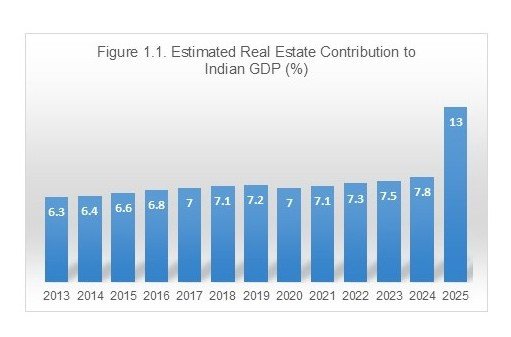

India’s real estate industry is one of the fastest-growing sectors in the country, contributing heavily to national income and employment as shown in Figure 1.1. Yet, its very scale makes it vulnerable to inefficiency, fraud, and regulatory challenges.

In this context, internal audit (IA) has emerged as a critical tool for maintaining transparency and strengthening governance.

IA is an independent assessment of how an organisation operates. Its goal is not just to find errors but to help management improve control, efficiency, and compliance. In the real estate sector, IA examines every stage of business activity like land acquisition, project financing, procurement, inventory maintenance, cost control, sales, marketing, collection from customers, revenue recognition and construction completion. Each of these areas carries significant financial exposure, making strong monitoring and control essential.

Real estate projects in India are complex because of long timelines, joint venture structures, multiple approvals from government authorities and compliance with laws like the Real Estate Regulations Act (RERA), the Foreign Exchange Management Act, goods and service tax (GST), income tax, stamp duty, etc. Non-compliance with these regulations attracts penalties and causes reputation loss.

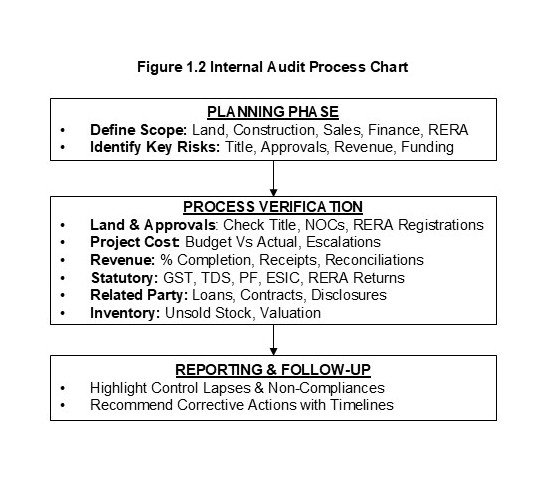

A primary benefit of IA lies in improving project efficiency. Large real estate projects involve substantial expenditure on materials, labour, and contractors, representing a huge investment. A well-structured audit (under applicable accounting standards) identifies unnecessary costs, detects irregular payments, and ensures that procurement processes remain transparent. Real estate IA should cover important areas as shown in Figure 1.2.

Fraud prevention is crucial in the real estate industry, where large transactions and multiple intermediaries increase the risk of financial irregularities. Internal audits help detect and prevent such risks by verifying documents, cross-checking records, and assessing internal controls. Auditors review contracts, payments, and sales data to uncover discrepancies and ensure transparency. By evaluating processes like authorisation and segregation of duties, they strengthen safeguards against misuse of funds or collusion.

Regular audits also promote ethics and accountability, reminding employees that every action is monitored. This proactive approach helps to prevent fraud and also helps management make aligned decisions, builds investor confidence, and protects the organisation’s assets and reputation, including developing trust among customers and other stakeholders.

IA has emerged as a vital pillar of governance in India’s real estate sector. By integrating data analytics, digital dashboards, RERA monitoring, and environmental, social and governance (ESG) insights, IA goes beyond error detection to enhanced and tech-enabled notification of any breach in set processes, and better control of the project and people across locations.

Jagruti Sheth draws on over 27 years of experience in corporate restructuring, M & A, capital structuring, valuations, due diligence, private equity deals, IPO, corporate law and exchange control regulations, and sick company restructuring. Jagruti is a partner at RNM India, Mumbai.

/https://storage.googleapis.com/ggi-backend-prod/public/media/7105/f14f89b7-d032-4a57-8499-0852546bf044.jpg)

/https://storage.googleapis.com/ggi-backend-prod/public/media/336/imagePcnehe.jpg)

/https://storage.googleapis.com/ggi-backend-prod/public/media/7111/7a52428d-5e91-45c9-8d88-9802f4dc2297.jpg)

/https://storage.googleapis.com/ggi-backend-prod/public/media/7110/3455a5d5-2ba4-47a4-b6c0-bf8cf9fbef02.jpg)

/https://storage.googleapis.com/ggi-backend-prod/public/media/7109/40f50fe9-a9e3-44f2-8401-9874c36feb9f.jpg)

/https://storage.googleapis.com/ggi-backend-prod/public/media/7108/4a95da83-6b25-41b7-99a1-5c891da90b5f.jpg)